Funding and Financing Projects

Funding and Financing Projects

Public-Private Partnerships (PPP) in Transport and Energy: BOOT (Build Own Operate Transfer) Implementation in Developing Regions

Introduction

Developing regions often face significant infrastructure gaps in key sectors such as transport (roads, railways, ports) and energy (power generation, transmission). Public-Private Partnerships (PPPs) have emerged as an effective strategy to mobilize private capital, expertise, and innovation to deliver these essential services.

A particularly suitable PPP model for capital-intensive infrastructure in developing contexts is BOOT – Build, Own, Operate, Transfer. It offers long-term financing solutions while ensuring eventual public ownership of strategic assets.

Understanding the BOOT Model

Under a BOOT arrangement, the private sector:

- Builds the infrastructure (e.g., highway, power plant).

- Owns it during a concession period (typically 20–30 years).

- Operates it to generate returns (through tolls, tariffs, or power purchase agreements).

- Transfers the asset back to the public authority in a pre-agreed condition.

This structure helps governments in developing regions deliver complex projects without upfront capital outlay, while attracting private investment through a revenue model that balances risk and return.

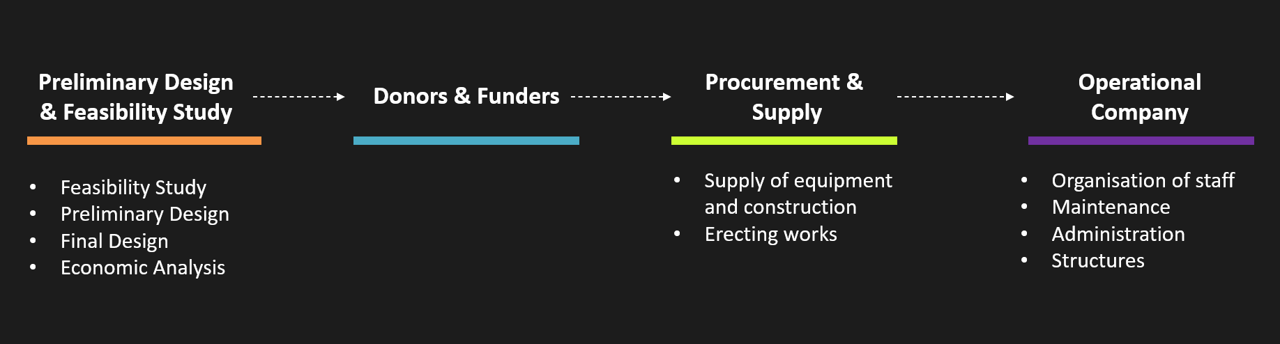

Key Phases of a BOOT Project in Developing Regions

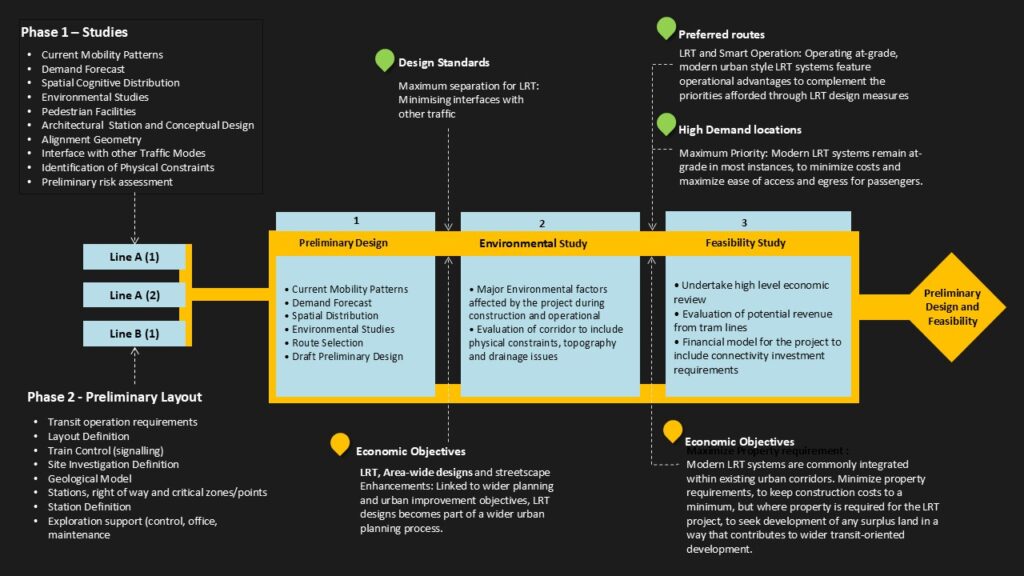

1. Project Identification and Feasibility

- Infrastructure Needs Assessment: Governments identify critical transport or energy gaps—e.g., a lack of rural road access or electricity shortages.

- Feasibility Studies:

- Technical: Assess the engineering requirements (e.g., terrain for a road, grid access for a power plant).

- Environmental and Social: Ensure compliance with environmental safeguards and community impact assessments.

- Financial: Analyze lifecycle costs, demand projections, and return on investment.

- Institutional: Examine the readiness of local legal and regulatory frameworks.

Often, development finance institutions (DFIs) like the World Bank, African Development Bank, or Asian Development Bank support these studies with grants or technical assistance.

2. Project Structuring and Procurement Planning

- PPP Suitability: BOOT is chosen when:

- The project is revenue-generating (e.g., toll road, solar power plant).

- Long-term private sector operation adds value.

- Risk Allocation:

- Construction risk to the private party.

- Regulatory and land acquisition risk often retained by the public.

- Currency or demand risk sometimes shared or mitigated with guarantees.

- Legal Framework Development: Some developing countries may need to establish PPP laws or create PPP units within ministries to oversee projects.

3. Design and Procurement Process

- Market Sounding: Engaging private investors early to test interest and capacity.

- Tendering Stages:

- Request for Qualification (RFQ) – To shortlist bidders based on technical, financial, and regional experience.

- Request for Proposal (RFP) – To solicit detailed bids, including designs, costs, and operational plans.

- Bid Evaluation: Based on value-for-money (VfM), lifecycle cost, innovation, and community benefit.

- Concession Agreement: Legal contract outlining roles, revenue sharing, tariff models, and dispute resolution mechanisms.

4. Financial Close

- Capital Structure:

- Typically a mix of equity, commercial debt, and concessional finance from DFIs.

- Instruments like Partial Risk Guarantees (PRG) or Viability Gap Funding (VGF) may be required to attract private investment in high-risk or low-income areas.

- Tariff Structuring:

- For energy: through long-term Power Purchase Agreements (PPAs).

- For transport: through tolls or government availability payments.

5. Construction Phase

- Design Finalization: Private partner completes detailed engineering within parameters set during procurement.

- Construction Execution:

- Subject to environmental and social safeguards.

- Monitored by third-party engineers or public supervisors to ensure compliance.

- Local Content: Often includes employment and subcontracting targets to benefit the local economy.

6. Operation and Maintenance

- Operations Commence: Private operator collects tolls or sells power, maintaining the infrastructure to performance standards.

- Monitoring:

- Performance metrics (e.g., road safety, power reliability).

- Government or independent auditors oversee service quality.

- Maintenance Regime: Asset is preserved through scheduled and corrective maintenance over the concession term.

7. Transfer

- End of Concession:

- Asset is handed over in “like-new” condition or as per maintenance schedule.

- Includes training of public personnel and handover documentation.

- Post-Transfer Operation:

- Either run by the government or re-tendered for new PPP operation.

Transport and Energy-Specific Examples in Developing Regions

- Transport:

- Lekki Toll Road (Nigeria) – A BOOT toll road project that faced challenges but highlighted the need for strong public oversight.

- Nairobi Expressway (Kenya) – A recent BOOT project with Chinese financing and operation, transferring back after ~30 years.

- Energy:

- Rwanda’s Gigawatt Global Solar Plant – A 8.5 MW BOOT solar farm with a 25-year PPA.

- India’s Ultra Mega Power Projects (UMPPs) – Structured under BOOT with long-term PPAs and land support by government.

Opportunities and Challenges in Developing Regions

Opportunities

- Leverage private capital for large-scale, high-impact projects.

- Improve infrastructure quality and service delivery.

- Strengthen local capacity and job creation.

Challenges

- Weak regulatory and legal environments.

- Political and currency risks.

- Limited capacity for project preparation and oversight.

- Affordability concerns in low-income communities.

Conclusion

The BOOT model, when well-structured, is a powerful tool for delivering transformative transport and energy infrastructure in developing regions. It provides long-term value by aligning private sector innovation with public interest, enabling governments to bridge infrastructure gaps without unsustainable borrowing.

However, success depends on sound project preparation, transparent procurement, risk-balanced contracts, and institutional capacity to monitor performance across decades.ly understand complex challenges and monopolize on our depth of innovation, sustainability and design standards.